|

STEX Research & Development has led us to Invent a Next Generation Financial

Instrument called the "Community Mutual Fund" - A 21st Century Solution. STEX -

community Mutual Funds products would be marketed under the Brand "Override" - signifying

overriding traditional thinking and operational mechanisms.

|

|

|

In traditional industry a large number of Financial firms offer a product called

the Mutual Fund. The Mutual Funds are funds created by collecting investments from

a large number of people and the funds are invested in the stock market to create

gains for the investors. The stock market is essentially a Zero Sum Game where when

One investor gains, another loses money. Stocks are the primary underlying instrument

of traditional mutual funds and therefore have a large number of disadvantages.

- STEX has conceptualized a Brand New Innovative and secure Financial Product called

the “Community Mutual Fund”. This Engineered financial Instrument would lead the

world's Economies and People to financial freedom.

|

|

Patent - (3047/MUM/2011)-SYSTEMS AND METHODS TO ENABLE AND ADMINISTER COMMUNITY

MUTUAL FUNDS.

|

|

|

|

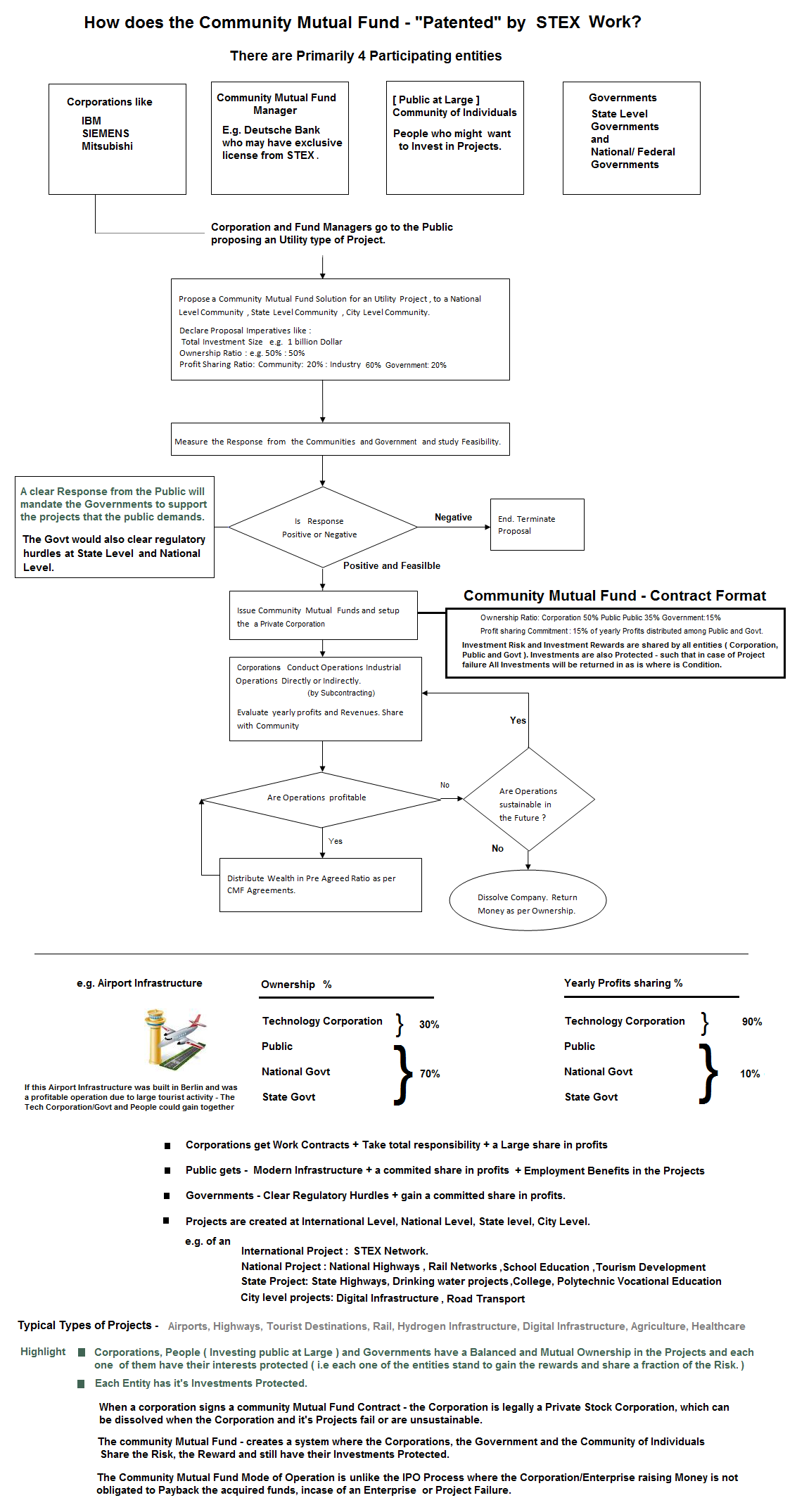

How do Community Mutual Funds Work ?

There are Four entities Involved

- The Individual belonging to a Community

- Governments [ National level or State level ]

- The Community Fund Manager

- The Technical Company or the Consortium that - provides technical knowhow Services

and Sub contracts work.

|

|

Inner Workings of Community Mutual Funds

|

- The Process

begins with a proposal for a Utlity/Industrial project by a Technology Corporation and a fund Manager.

A response to the Project is received from the public and The contract is made positive

only after an evaluation of the response/interest from the Public [ Community of

Individuals ] and Supporting Governments. The three entities [ Corporation - Public-

Goverments] Invest into the projects together.

-

The Ratio of Ownership and Ratio of Profit Share are Pre-declared in

the Community Mutual Fund contract proposal in the Initial Stage.

e.g.50% ownership for the Community + 20% Ownership for the Government + 30% ownership

for the Consortium Company. Note: The ownership Ratio has no corelation to the Profit

Share ratio pre-agreed in the Contract. e.g. 90% Profits retained by the Corporation

or Consortium company and 10% Profits distributed to government and Communities.

-

Please Note: A guaranteed 10% Profit percentage is a far more systematic and attractive

Instrument, rather than than relying on a dividend from a stock. Dividend yields

usually range from 0% to 5% on an escalated stock price. Many companies dont even

declare dividends, because they are not obligated to do so.

-

The Community Mutual Funds are of Four Types types - International Projects, Nation

Level Funds ( For National Development ), State Level Funds( For State Development),

City Level Funds( For City/Town Development ).

-

The Wealth created by the development of Communities would be shared between the

Community of Individuals and the Consortium company in the ratio of Ownership every

year.

-

The Technical Corporation/Consortium Company takes responsibility of all Projects and Operation,

by directly offering services or Subcontracting the work.

-

The Community Fund Manager would manage the entire funds collection and operations

and distribution of wealth.

-

Note: National Governments and State Level Governments may also Investment along

along with public Communities and they further clear regulatory hurdles.

|

|

|

The Advantages of Community Mutual Funds

|

-

The Communities get developed as they get necessary Infrastructure and Necessities.

This improves the standard of living.

-

Corporation/Consortium Company get Work Contracts.

-

Wealth created is shared between Community of Individuals, Governments and Corporation/Consortium Companies .

-

There is a positive certainty by Agreement and logic that Communities of Individuals

would use/utilise the Infrastructure and services provided by the Corporation/Consortium companies,

so the Operations & economics cycle is profitable and sustainable.

-

A cycle of Job Creation and Wealth Creation cycle is Setup - We call this " A Smarter

Engineered Inytelligent Planet".

-

By Measuring the demand for any kind of services/Infrastructure(Healthcare/Road/Rail/Aviation/Electricity,

Water..) through the Community Mutual Funds, Corporation/Consortium Companies may be able

to Draw intelligent conclusions whether the investments and operations would be

sustainable and profitable.

-

All information about the Accounts( Expenditures and Profits ) would be transparently

shared between the community of individuals and the Consortium company.

-

Nation level and State Level Governments may invest into the projects and it would

allow easier Regulatory Clearances.

|

|

The Disadvantages of Community Mutual Funds

|

-

There is a Disadvantage though that the Community Mutual Funds may be Transferable

but not rectractable or Withdrawable, however if the consortium companies dont see

a bright future for the services, the Contract deal between the community and the

Consortium companies may be "Dissolved" with the investments returned as per the

ratio of Investment.

-

Another Disadvantage is that this kind of Instrument would be useful only for those

sectors or solutions which are essential necessities for a community to maintain

a good standard of living. Ths instrument may not be useful if the the solution

in the context is not a community solution - for e.g you cannot raise money to open

Burger Chains through Community Mutual Funds, unless ofcourse the entire community

wishes to avail of the burger chain services.

|